Inflation in India is spreading its heat all over where earnings rapidly declining and the prices of goods are increasing at a faster pace. People are now relying more on credit tools and instruments to bear their expenses and getting trapped into big interest calculations by the banking institutions . Against such exploitation , a startup named Lazypay found a mid solution for the people to obtain credit for their expenses and repay their credits without interest.

Lazypay loan app is getting popular day by day and is used by numerous people all over India . The app provides personal loan and petty loans for bearing small day to day expenses. How you can obtain loan from Lazypay and make your bill payments taking credit from the company without bearing any additional interest burden is what all we have discussed in this article for you.

LazyPay Best Loan App Online

LazyPay is a credit solution service provider company where the company is offering small personal loan and credit options to its customers to obtain loan from the company to make small bill payments , recharges or even making small urgent payments .

The company is offering loan without any interest and steady repayment options in EMI. The USP of the company to gather customers is its no interest charges on loans for bill payments where a person with a verified account on Lazypay can make recharge payments on the account with returning the same amount to the company within 15 days.

For credits required later than 15 days the company offers EMI options also for repayment.

How much amount of loan you can obtain from Lazypay ?

On Lazypay , their is no particular limit of loan that you can take on the platform as the amount of credit provided depends on your credit-ability and last repayments with the company. On Lazypay loan app , you can start with a minimum loan of Rs 5000 for making payment of your bills and can repay it without interest or charges within 15 days.

With the Xpress Cash feature of Lazypay , you can obtain a loan of Rs 5 lakh or below from the company without any major complications and applicable nominal interest rate compared to interest rate charge by banks or NBFCs.

Opening an Account as an Individual on LazyPay app

To open an Account or credit account on Lazypay app , you can start by signing up on the official website or on the mobile application of the company. You can sign up with your mobile number and email .

Once your account is created , it is necessary to follow the steps which require doing the KYC and also uploading the necessary documents as asked by the company . Once the account KYC is completed , you can raise the loan request or can straight away make payments using the allotted Lazypay UPI Id.

You can also request to receive the credit amount in your bank account linked with your Lazypay account for spending .

Products and Services Offered by LazyPay application

Lazypay currently offers 3 services on their platform and mobile application :

- Xpress CREDIT which provides loan upto Rs 5 lakh as personal loan from the company.

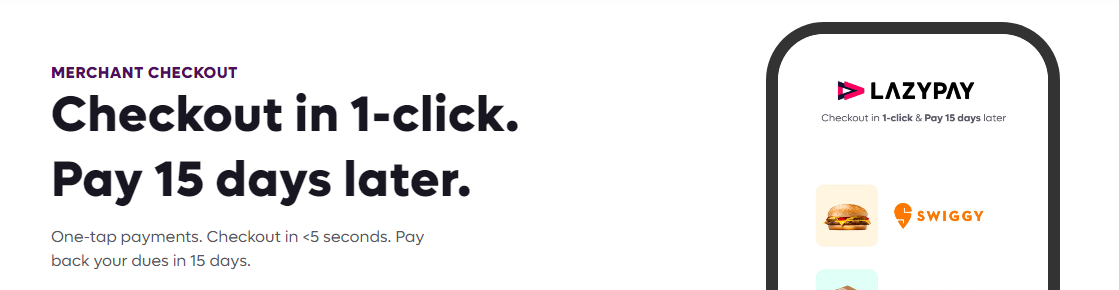

- Merchant Checkout which includes making payments to associated merchants of the platform like Zomato, Tata Sky or Dunzo etc.

- Bill Pay where you can make payments of your bills with taking credit from LazyPay and repaying the company back in 15 days or in EMIs of 3,6,9,12.

How much amount of bills you can pay with LazyPay without interest or charges ?

There is no specific limit of credit ascertained by LazyPay to pay without interest and charges . If some amount is taken as loan it has to be paid with interest using the Xpress Credit facility while the credit taken for bill payment with the associated partners it can be repaid within 15 days .

What if you do not repay your Loans with LazyPay ?

If you do not repay the credit or personal loan amount taken from the Lazypay mobile app , the company might be forced to add more interest penalty on your credit amount and also can undertake a legal action against you for non payment .

Xpress Loan with LazyPay for Upto Rs 5 lakh

XpressCash Loan is a facility offered by Lazypay to provide loan to people for upto 5 lakh based on their credit score calculation and past repayment and loan history checked . The company offers loan at no submission of physical documents from its clients also provides loan for upto Rs 5 lakh directly deposited in the Lazypay wallet for making payments to different parties.

For application of XpressCASH you need to check your eligibility for which you have to sign up on the Lazypay platform and answer few questions. If you are a salaried employee , then you can easily obtain a loan from this company without any major complications.

How bill payments with LazyPay work ?

On LazyPAY , you signup to create a LazyPay wallet app where the company provides a credit limit to spend on making payments of your bills . The credit limit is decided by the company based on your previous banking and credit history .

You can pay for the bills through the LazyPay wallet instantly without holding any balance in your wallet where the UPI payment system of Lazypay will be used to scan the website or platform to make the bill payment.

What additional you can do on LazyPay for tracking expenses ?

On LazyPay , you can also put reminders on your expenses , record your monthly spending and can even automate your payments with the applications providing details of the loan and expenses to clear during the month using bill payment option.

Is Lazypay a trusted application to obtain loan for small bills and expenses ?

LazyPay is a trusted application to obtain loan and submit your documents for KYC , considering the company has positive reviews on trustpilot you can trust the company for obtaining small petty loans for bills or personal loan .